When Money Fails: Preparing for Economic Emergencies

Our digital financial world feels secure—until it isn’t. Through direct experience in multiple disasters, I’ve observed how quickly modern systems crumble when catastrophe hits. These insights reveal what truly matters when everyday commerce becomes a distant memory.

Hard Truths from Crisis Situations

- Electronic payments vanish instantly

- Paper currency outlasts digital alternatives

- Social connections surpass bank balances

- Standard investments frequently become useless

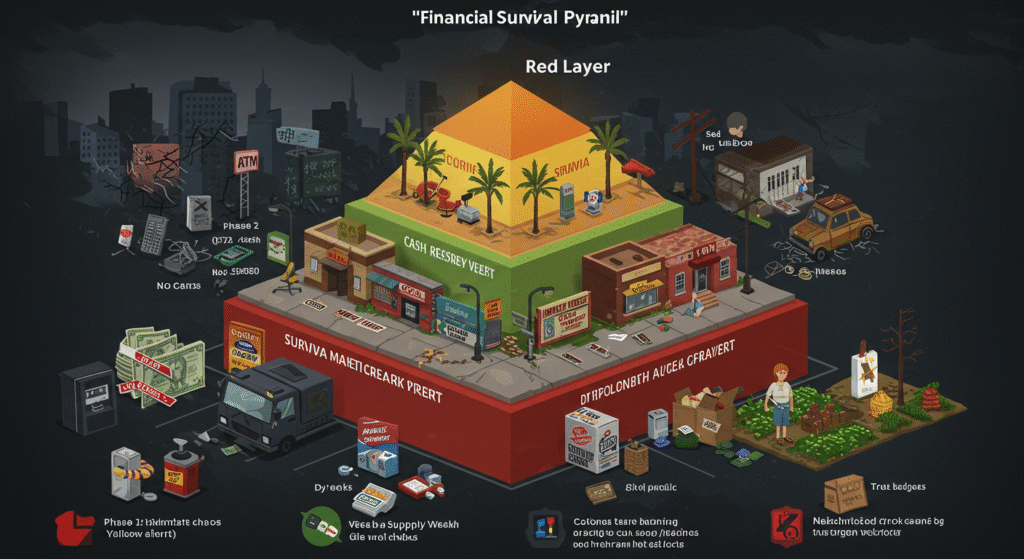

Financial Disruption Timeline

Phase 1: Initial Breakdown (First 3 Days)

Lessons from Hurricane Helene:

- No power means no digital transactions

- Cash machines empty immediately

- Only physical money buys critical supplies

Essential Readiness:

- $300-500 in mixed small bills

- Backup payment cards with modest funds

- Retail gift cards for basic purchases

Phase 2: Ongoing Crisis (Week 1-4)

During sustained emergencies:

- Distribution networks falter

- Local money loses purchasing power

- Temporary trading systems appear

Practical Steps:

- Reserve cash for monthly expenses

- Keep desirable trade items (medicines, tools)

- Establish local supply relationships

Phase 3: Complete Collapse (Month+)

Documented patterns show:

- Official currencies may fail entirely

- Typical wealth becomes inaccessible

- Real-world abilities determine survival

Lasting Solutions:

- Develop barterable skills (repairs, nursing)

- Create mutual aid networks

- Learn traditional self-reliance methods

Evaluating Financial Options in Crises

Cash: The Most Reliable Medium

Advantages:

- Universally accepted

- Requires no infrastructure

- Easily divisible

Storage Tips:

- Keep in fireproof/waterproof containers

- Distribute in multiple locations

- Use small denominations

Electronic Payments: High Failure Risk

Limitations:

- Depending on the functioning infrastructure

- Subject to account freezes

- Often inaccessible during emergencies

Precious Metals: Problematic in Practice

Challenges:

- Difficult to authenticate

- Hard to divide for small purchases

- Makes holders targets for theft

Cryptocurrencies: Digital Limitations

Reality Check:

- Require internet access

- Need willing trading partners

- Value can fluctuate wildly

Building True Financial Resilience

Essential Preparations

- Cash Reserves: 1-2 months’ expenses in small bills

- Barter Goods: Useful, non-perishable items

- Community Ties: Relationships with neighbors and local businesses

- Practical Skills: Abilities others will value

Common Mistakes to Avoid

- Over-reliance on digital systems

- Storing wealth in single forms

- Neglecting local networks

- Focusing only on financial assets

Actionable Steps for Preparedness

- Start Small: Begin with $500 emergency cash fund.

- Diversify Storage: Use multiple secure locations.

- Build Skills: Learn basic repair and medical techniques.

- Connect Locally: Develop relationships with neighbors.

- Practice Scenarios: Test your preparedness periodically

Remember: In times of crisis, flexibility and adaptability matter more than any single financial asset. The most prepared individuals combine prudent financial measures with strong community connections and practical knowledge.

Share this content: