Introduction: Turning an Idea into Reality

Have you ever pondered the possibility of earning from the stock market or forex trading without being tethered to your computer? I certainly have. Some time ago, I was seeking a way to make more informed trading decisions without the need to monitor prices constantly. This quest led me to the fascinating world of arbitrage and the potential of creating a bot to do the heavy lifting for me.

Building a trading bot was a new frontier for me, but I was determined to embark on this learning journey. In this article, I’m excited to share my experience of building my first arbitrage bot, focusing on its functionality, the hurdles I encountered, and the valuable lessons you can glean from my journey.

If you’re interested in understanding how bots work in trading—whether it’s in forex, stock markets like Robinhood, or WeBull—this story will give you an insight into how a simple idea can be turned into a fully functioning trading bot.

What is Arbitrage?

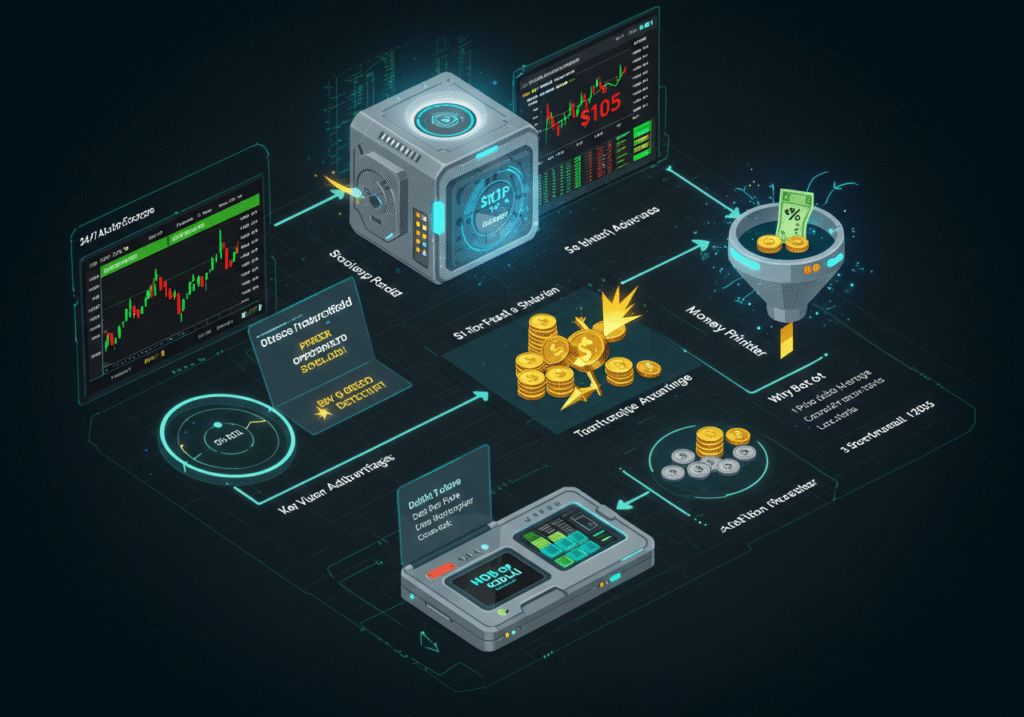

Let’s break it down. Arbitrage is the practice of exploiting price differences between markets. For example, if a stock is selling for $100 in one market and $105 in another, you can buy it in the first market and sell it in the second, making a profit of $5 per share.

This is the core of my bot’s function. I wanted a bot that could track multiple platforms, such as Robinhood stock or forex platforms, and automatically execute trades when it identified price differences.

Why Build an Arbitrage Bot?

Creating an arbitrage bot opens up a world of possibilities. It allows you to exploit price discrepancies around the clock. Markets like forex and stock trading can be unpredictable, but a bot works tirelessly, scanning for opportunities even while you sleep. For instance, stock market prices can fluctuate in real-time, and if you’re not vigilant, you might miss a lucrative opportunity. However, with a bot, you can capitalize on these price changes and execute trades, thereby transforming your trading experience.

The Basics of Trading Bots

To understand how I built my arbitrage bot, you first need to understand what a trading bot is. A trading bot is a software that interacts with a market (such as forex or stock exchanges) and performs tasks, such as buying and selling, automatically based on certain conditions you set.

In my case, I programmed the bot to search for specific price differences across different exchanges, analyze when these differences are substantial enough to be profitable, and then execute the trade automatically—no need for me to be glued to the screen.

Step-by-Step: How I Built My Arbitrage Bot

Now that you have a basic understanding of what an arbitrage bot is, let me walk you through the process of how I built mine.

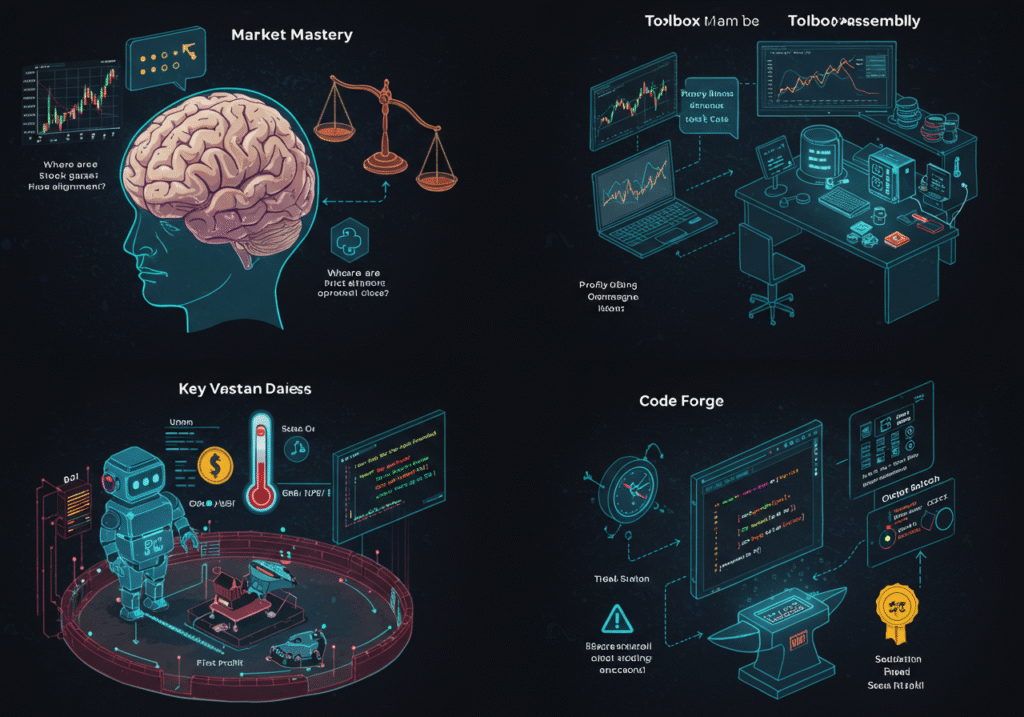

Step 1: Understanding the Markets

First, I had to understand the markets where I wanted my bot to operate. I focused on forex and stock markets, using platforms like Robinhood and WeBull. These platforms allow you to buy and sell stocks with ease, but they also offer arbitrage opportunities when their prices don’t align with each other.

For example, if a forex currency pair is undervalued on one platform but overvalued on another, that’s a potential arbitrage opportunity. My bot had to understand these conditions and calculate the best time to enter and exit the trade.

Step 2: Selecting the Right Tools

I couldn’t just start writing the code for the bot without the right tools. I needed to use APIs (Application Programming Interfaces) that would allow the bot to interact with the trading platforms. Most trading platforms, such as Robinhood stock or forex brokers, offer these APIs, which provide your bot with access to live market data, allowing it to know when to trade.

For my bot, I used Python, as it’s easy to learn, flexible, and has plenty of libraries for working with APIs.

Step 3: Writing the Code

This was the part I had been waiting for. I started writing the code to fetch data from the trading platforms and then built an algorithm that could identify arbitrage opportunities. The algorithm was designed to compare prices across different platforms and calculate potential profits based on the price differences. The key challenge was ensuring that the bot would make profitable trades fast enough before the price differences disappeared.

The code had to handle multiple conditions, such as ensuring the price difference was large enough to cover transaction fees and still yield a profit. I also needed to make sure that the bot could place buy and sell orders quickly.

Step 4: Testing the Bot

Once the bot was programmed, I had to test it. This is where things got tricky. I initially used a small amount of money to test the bot on various platforms. It’s essential to test with real-time data to assess how well the bot performs in actual market conditions.

Initially, the bot made a few mistakes. Sometimes it would trigger trades too early or too late. But after a few tweaks, I had it working smoothly.

Challenges I Faced While Building the Bot

Creating an arbitrage bot wasn’t all smooth sailing. Here are some of the key challenges I encountered:

1. Latency Issues

- Sometimes, price differences would appear on the platforms, but by the time the bot reacted, the opportunity would be gone. I had to optimize the bot’s speed to minimize this latency.

2. Risk Management

- Even though arbitrage is supposed to be low-risk, there’s always a chance that something unexpected could happen. I had to build safeguards into the bot to stop trading if the risk became too high.

3. Real-Time Data

- The prices of the forex and stock markets are constantly changing. My bot needed access to real-time data, which wasn’t always easy to obtain. I had to make sure I was getting up-to-date information from reliable sources.

How the Bot Improved My Trading

Once I got the bot working, I began seeing real results. The bot was able to consistently find minor price differences between forex platforms and stock market exchanges. By automating the process, I could focus on other investments, while the bot did the heavy lifting.

It’s also much more efficient than doing manual arbitrage because the bot doesn’t get tired, make mistakes, or forget about a potential trade. It’s always on the lookout for opportunities.

Conclusion: The Future of Automated Trading

Building my first arbitrage bot was an exciting journey. I learned a great deal about programming, trading, and how automation can be a powerful tool for generating profits in the stock and forex markets.

Now, as I continue to improve my bot, I see even more potential for automated trading in the future. Whether you’re interested in forex, stocks, or other forms of trading, bots are an efficient way to keep up with the fast-paced nature of markets.

If you’re considering building your arbitrage bot, remember that it’s a process that requires time, patience, and learning. But with the right tools, strategies, and a bit of persistence, you can build something compelling.

Share this content: