About a decade ago, I thought I was being pretty clever. After reading a couple of articles and watching some YouTube videos, I thought I was ready to give crypto a try.

These are expensive lessons I’ve learned so that you can skip the pain.

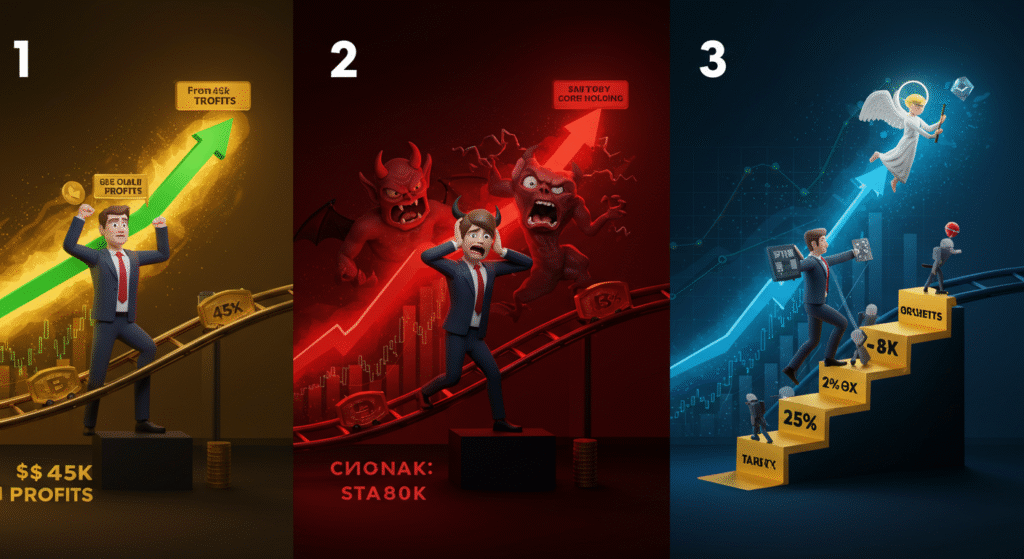

1. Thinking You Can Time the Market

- What I did: Sold Bitcoin at $8,000 in anticipation of it crashing, only to find it hit $20,000.

- Why it’s deadly: Markets move faster than your emotions. You sell bottoms and buy tops.

Do this instead: Decide on an affordable-to-lose amount each month and buy regularly. This strategy, known as ‘dollar cost averaging’, involves investing a fixed amount of money at regular intervals, regardless of the market conditions. It’s boring, yet it works.

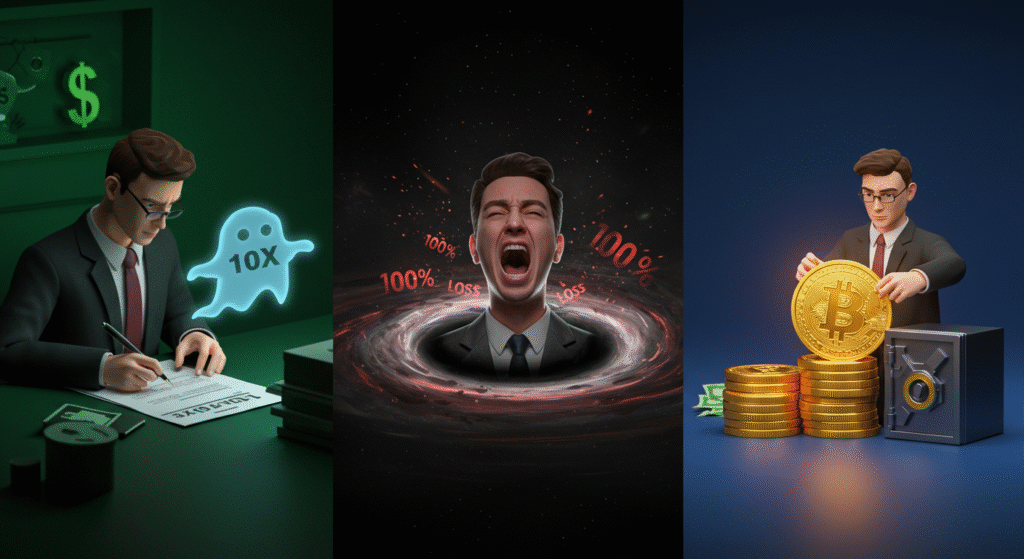

2. Going All-in on the Next Bitcoin

- What I did: Invested $15,000 into a coin because some influencer said it would “10x in 30 days.”

- Why it’s deadly: If someone knew which coin would explode, they’d be buying it themselves, not telling you on Twitter.

Do this instead:

- By all means, start with Bitcoin and Ethereum (70% of your crypto budget)

- Research any other coin for weeks before buying

- Never invest more than 5% in any single altcoin

3. Storing Everything on Exchanges

- What I did: Sunk all crypto in an exchange which got ‘hacked’ (turned out it was an insider job)

- Why it’s deadly: When crypto sits on an exchange, you don’t own it. You own an IOU that can disappear overnight.

Do this instead:

- Buy a hardware wallet for anything over $1,000

- Use exchanges only for buying, not storing

- Remember: “Not your keys, not your crypto.”

4. Chasing Green Candles

- What I did: Saw a coin pumping 50% and bought at the peak, thinking it would keep going.

- Why it’s deadly: By the time you see the pump, smart money is already selling to you.

Do this instead:

- Buy when everything feels hopeless and boring.

- Sell when your barber starts giving you crypto tips.

- If it’s on the front page of Reddit, you’re probably too late.

5. Ignoring Taxes

- What I did: Started with trading and earned 30k dollars, squandered every last penny of it, only to be slapped with a $12,000 tax bill.

- Why it’s deadly: Every crypto transaction is taxable. Yes, even the swapping of coins.

Do this instead:

- Track every transaction with applications like Koinly or CoinTracker.

- Save 30% from profits for taxes every year.

- Find a Crypto-American accountant to advise you.

6. Falling for Hype on Social Media

- What I did: Bought a coin, it had rocket emojis and diamond hands written all over Twitter.

- Why it’s deadly: Hype campaigns are designed to extract money from newcomers.

Do this instead:

- Mute words like moonshot, 100x, and diamond hands.

- Research the team, technology, and real-world use cases.

- If the marketing is louder than the technology, run.

7. Trading Instead of Investing

- What I did: Tried Day Trading in crypto and lost 60% of my portfolio in three months.

- Why it’s deadly: You’re competing against algorithms and professional traders with million-dollar setups.

Do this instead:

- Buy quality projects and hold for years.

- Check prices monthly, not hourly.

- Remember: time in market beats timing the market.

8. Using Money Borrowed as Leverage

- What I did: 10X in leverage investments — even visited banks thinking short gains will be emanated. Have lost everything in one trade.

- Why it’s deadly: Just like in gains, the leverage multiplies your losses. Even small moves can wipe one out completely.

Do this instead:

- Never borrow money for crypto investments.

- Don’t use margin or leverage until you’ve been profitable for years.

- If you can’t afford to lose it, don’t risk it.

9. Having No Exit Strategy

- What I did: Watched it shoot up from $5,000 to $45,000 , back down to $8,000, which, of course, resulted from not knowing when to sell.

- Why it’s deadly: Greed makes you hold it too long. Fear makes you sell too early.

Do this instead:

- Decide your sales targets before you buy.

- Take some profits on the way up (25% at 2x, 25% at 5x, etc.).

- Keep a core position for the long term.

10. Panicking During Crashes

- What I did: Sold everything during the 2018 crash and missed the entire 2020–2021 bull run.

- Why it’s deadly: The crash looks like the end of the world, but it is a buying opportunity.

Do this instead:

- Expect 80% drawdowns as usual in crypto.

- Buy more when everybody is selling.

- Remember that Bitcoin has “died” 400+ times according to the media.

The Mindset That Works

After losing 50,000 bucks and learning this the hard way, I changed my whole way of thinking:

Decadal thinking over daily. Those who got rich through crypto were those who bought and held for a long period through cycles. Remember, patience is a virtue in the world of investing.

Boring wins. Dollar cost averaging into Bitcoin or Ethereum isn’t sexy, but it is effective and safe. It’s a strategy that can provide a sense of security in the volatile world of cryptocurrencies.

Education beats speculation. Invest more in learning about this technology called blockchains than looking at price charts. Knowledge is power in the world of crypto investing.

Position sizing matters. This refers to the proportion of your portfolio that you allocate to a particular investment. Never invest more than you can afford to lose completely.

Share this content: