First off, I am not a Bitcoin Maxi. I don’t boast about being one of the early adopters who repurchased the crypto in 2013 when it was under $100 USD. I don’t sport laser eyes on my social media profile or advocate for putting 100% of discretionary income into Bitcoin. I am a rational thinker with an engineering degree. I believe in facts and figures. Therefore, my argument for owning Bitcoin is rooted in logic and reason.

Secondly, while everyone should have crypto exposure, Bitcoin stands out as the most promising option. I would recommend it to 90% of my friends and family, but always as a modest portion of their planned investment allocation. The potential of Bitcoin is such that if you invested at the right time, it could easily become the cornerstone of your portfolio wealth. Even if you have a significant portion of your portfolio in Bitcoin, I would still advise investing 5–10% of new money in any given year.

So what’s the reason?

My wife and I lived in the Pacific Northwest for almost 10 years. When we first moved, we rented a townhome apartment. It was nice, on a hill surrounded by tall pine trees, something right out of a movie. The plan was to stay there for about 4 years, until we sold our home out of state, and then save more money to buy a house. At the time, we were paying around $1,500 for that 2-bedroom, 2-bath townhome, with a tandem 2-car garage. Our out-of-state home took much longer to sell, so we were paying two housing payments. By the time that house was sold, we couldn’t afford anything in our new area. This was around 2010.

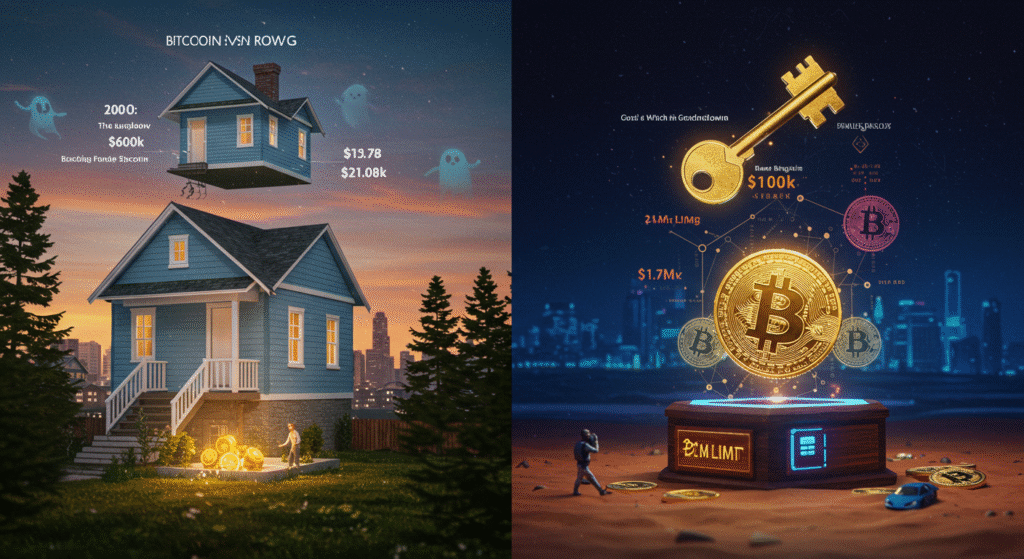

We found a home for rent, only 1600 sq ft., going for $2,095 per month. We jumped on it, and by the grace of God, our application was chosen because the other couple bidding had a non-working wife. The landlord felt more comfortable knowing that my wife and I had jobs. I’ve worked part-time in real estate for decades, and while that home was not for sale, checking the MLS, the sales price would have been around $600,000 if we had tried to buy it. Remember, this was 2010.

After staying there several years, every mailing list company and marketer associates your name with the property, even though you’re not the owner.

Although we moved from that place over 10 years ago, I still receive emails today from real estate brokers and interested parties who believe I’m the owner. What is the offer price now?

$1.7 million. Yes, $1,700,000!

Imagine if I had purchased that home for $600K way back then.

On a recent trip, we stopped by the old place to see what had changed.

The lot looked exactly like we left it. A branch I had planted from a fallen tree had taken root — it almost brought a tear to my eye.

The paint on the outside of the home was the same, and recent pictures from inside showed that nothing had been upgraded. Same wood floors, same plumbing fixtures, even the same interior paint.

But now, through the magic of inflation and being right down the street from a central tech campus, with no room to build any new homes, this same home was worth $1.7MM. We affectionately called that home the little bungalow, because it was a cute sky blue, one-story house at the edge of a nature preserve.

Somehow, today, “society” or “the market” now values this same property at almost $2 million, despite the functionality of the property remaining unchanged over the 2.5 decades since it was first built. It’s still 1600 sq ft, it still has the tiny 3rd bedroom near the back of the house. The backyard still suffers from moss overgrowth due to the tall trees and the shade they provide.

The “market” is fake — entirely made up by those with enough money, willing to buy that property at that price. And they are not buying it to lose money; they are buying it with the intent that this “asset” will either maintain its value or ideally, go up in value.

This means selling it to the next “sucker,” (sorry) I mean buyer willing to pay $1.9 million the next time the home hits the market. That person will think they’re getting a deal, because it’s just under $2 million.

And the madness keeps on going.

So, someone wakes up one day and says, “Hey, I am going to create my store of value out of thin air; it will be a digital coin.”

But the real genius was not in the virtual coin itself; it was in making it scarce (a limited supply of 21 million). So, just like there was no more land to build more $600K homes, Bitcoin was designed with a finite supply of coins. And once you had enough people agree that there was value in this digital scarcity, it was off to the races.

The perception of value is what makes everything ‘fake’ or, more accurately, artificial. For instance, if you were to give me a Lamborghini and drop me on a deserted island, the value of that car would be zero, regardless of the materials used to make it. This example illustrates the point that value is not inherent in an object, but rather a product of human agreement.

Today, we agree that my little bungalow is worth $1.1MM more than it was 10 years ago. Today, we say Bitcoin is worth around $100,000.

It’s all an agreement being made in real-time. Everything is just a manufactured agreement. So, whether it’s paper, gold coins, wood chips, tobacco leaves, or ones and zeros over the Internet, it’s all just an agreement.

I, all alone, on that deserted island with my Lambo, have no one else to agree with. So, my Lambo is worth zero dollars, or it’s worth $100MM; it doesn’t matter.

People like to confuse themselves by saying, “Well, a house provides shelter, so that’s why it has value, unlike Bitcoin.”

Man needs food, water, and shelter to survive. So, while yes, you may say that a structure with four walls and a roof should always be worth more than Bitcoin, you can’t make a good argument, why that structure changes value over time based on the agreement of two or more people, especially ones with enough “paper money” to bid well over the asking price to secure it. The value is a moving target, never fixed and easily manipulated based on those bidding on that particular day at that specific time.

Housing has long become divorced from reality , and so its value is a lot less meaningful than people like to admit.

Remember the 2007 financial crisis?

There are homes in the Atlanta region that were purchased at sixty cents on the dollar simply because that’s all they could be deemed worth at the time. Nothing changed about the house; the perception of money and who owed the most debt is what suddenly made that house worth only 60% of what it used to be. Most of those homes have now recovered in “value.”

Is the value of Bitcoin random?

Well, no more random than the value of my little bungalow. The property is only worth $1.6MM, which is one Bitcoin less than the current market price.

So, I’m not here to convince you that Bitcoin has some inherent value that crosses all space and time. I’m here to convince you that most of modern society is no more than a failing game at best, once you have basic food, water, and shelter.

And if it’s agreed that homes, Bitcoin, stocks, and baseball cards have value, then just play the damn game, and build these things called assets. It’s really that simple.

You don’t have to rationalize it or call it fake out loud.

Your bills are due at the end of the month, and if someone says they’ll give you one Bitcoin, you sure as hell will take it and cash it in. You’re not going to sit there on some philosophical high horse and question if it has value and why.

Bitcoin has value until it doesn’t; so, for now, you decide if it’s worth it to you. You don’t have to like the game, but the game is what it is. I am using all financial tools to my advantage until they no longer serve a good purpose.

The agreement is the agreement — for now. And that’s why I want more Bitcoin.

Share this content: